On the Expected Utility Objection to the Dutch Book Argument for Probabilism

I've just signed a contract with Cambridge University Press to write a book on the Dutch Book Argument for their Elements in Decision Theory and Philosophy series. So over the next few months, I'm going to be posting some bits and pieces as I get properly immersed in the literature. The following came up while thinking about Brian Hedden's paper 'Incoherence without Exploitability'.

What is Probabilism?

Probabilism says that your credences should obey the axioms of the probability calculus. Suppose $\mathcal{F}$ is the algebra of propositions to which you assign a credence. Then we let $0$ represent the lowest possible credence you can assign, and we let $1$ represent the highest possible credence you can assign. We then represent your credences by your credence function $c : \mathcal{F} \rightarrow [0, 1]$, where, for each $A$ in $\mathcal{F}$, $c(A)$ is your credence in $A$.

Probabilism

If $c : \mathcal{F} \rightarrow [0, 1]$ is your credence function, then rationality requires that:

(P1a) $c(\bot) = 0$, where $\bot$ is a necessarily false proposition;

(P1b) $c(\top) = 1$, where $\top$ is a necessarily true proposition;

(P2) $c(A \vee B) = c(A) + c(B)$, for any mutually exclusive propositions $A$ and $B$ in $\mathcal{F}$.

This is equivalent to:

Partition Probabilism

If $c : \mathcal{F} \rightarrow [0, 1]$ is your credence function, then rationality requires that, for any two partitions $\mathcal{X} = \{X_1, \ldots, X_m\}$ and $\mathcal{Y} = \{Y_1, \ldots, Y_n\}$,$$\sum^m_{i=1} c(X_i) = 1= \sum^n_{j=1} c(Y_j)$$

The Dutch Book Argument for Probabilism

The Dutch Book Argument for Probabilism has three premises. The first, which I will call Ramsey's Thesis and abbreviate RT, posits a connection between your credence in a proposition and the prices you are rationally permitted or rationally required to pay for a bet on that proposition. The second, known as the Dutch Book Theorem, establishes that, if you violate Probabilism, there is a set of bets you might face, each with a price attached, such that (i) by Ramsey's Thesis, for each bet, you are rationally required to pay the attached price for it, but (ii) the sum of the prices of the bets exceeds the highest possible payout of the bets, so that, having paid each of those prices, you are guaranteed to lose money. The third premise, which we might call the Domination Thesis, says that credences are irrational if they mandate you to make a series of decisions (i.e, paying certain prices for the bets) that is guaranteed to leave you worse off than another series of decisions (i.e., refusing to pay those prices for the bets)---in the language of decision theory, paying the attached price for each of the bets is dominated by refusing each of the bets, and credences that mandate you to choose dominated options are irrational. The conclusion of the Dutch Book Argument is then Probabilism. Thus, the argument runs:

The Dutch Book Argument for Probabilism

(DBA1) Ramsey's Thesis

(DBA2) Dutch Book Theorem

(DBA3) Domination Thesis

Therefore,

(DBAC) Probabilism

The argument is valid. The second premise is a mathematical theorem. Thus, if the argument fails, it must be because the first or third premise is false, or both. In this paper, we focus on the first premise, and the expected utility objection to it. So, let's set out that premise in a little more detail.

In what follows, we assume that (i) you are risk-neutral, and (ii) that there is some quantity such that your utility is linear in that quantity---indeed, we will speak as if your utility is linear in money, but that is just for ease of notation and familiarity; any quantity would do. Neither (i) nor (ii) is realistic, and indeed these idealisations are the source of other objections to Ramsey's Thesis. But they are not our concern here, so we will grant them.

Ramsey's Thesis (RT) Suppose your credence in $X$ in $c(X)$. Consider a bet that pays you £$S$ if $X$ is true and £0 if $X$ is false, where $S$ is a real number, either positive, negative, or zero---$S$ is called the stake of the bet. You are offered this bet for the price £$x$, where again $x$ is a real number, either positive, negative, or zero. Then:

(i) If $x < c(X) \times S$, you are rationally required to pay £$x$ to enter into this bet;

(ii) If $x = c(X) \times S$, you are rationally permitted to pay £$x$ and rationally permitted to refuse;

(iii) If $x > c(X) \times S$, you are rationally required to refuse.

Roughly speaking, Ramsey's Thesis says that, the more confident you are in a proposition, the more you should be prepared to pay for a bet on it. More precisely, it says: (a) if you have minimal confidence in that proposition (i.e. 0), then you should be prepared to pay nothing for it; (b) if you have maximal confidence in it (i.e. 1), then you should be prepared to pay the full stake for it; (c) for levels of confidence in between, the amount you should be prepared to pay increases linearly with your credence.

The Expected Utility Objection

We turn now to the objection to Ramsey's Thesis (RT) we wish to treat here. Hedden (2013) begins by pointing out that we have a general theory of how credences and utilities should guide action:

Given a set of options available to you, expected utility theory says that your credences license you to choose the option with the highest expected utility, defined as:

$$\mathrm{EU}(A) = \sum_i P(O_i|A) \times U(O_i)$$

On this view, we should evaluate which bets your credences license you to accept by looking at the expected utilities of those bets. (Hedden, 2013, 485)

He considers the objection that this only applies when credences satisfy Probabilism, but rejects it:

In general, we should judge actions by taking the sum of the values of each possible outcome of that action, weighted by one's credence that the action will result in that outcome. This is a very intuitive proposal for how to evaluate actions that applies even in the context of incoherent credences. (Hedden, 2013, 486)

Thus, Hedden contends that we should always choose by maximising expected utility relative to our credences, whether or not those credences are coherent. Let's call this principle Maximise Subjective Expected Utility and abbreviate it MSEU. He then observes that MSEU conflicts with RT. Consider, for instance, Cináed, who is 60% confident it will rain and 20% confident it won't. According to RT, he is rationally required to sell for £65 a bet in which he pays out £100 if it rains and £0 if is doesn't. But the expected utility of this bet for him is$$0.6 \times (-100 + 65) + 0.2 \times (-0 + 65) = -8$$That is, it has lower expected utility than refusing to sell the bet, since his expected utility for doing that is$$0.6 \times 0 + 0.2 \times 0 = 0$$So, while RT says you must sell that bet for that price, MSEU says you must not. So RT and MSEU are incompatible, and Hedden claims that we should favour MSEU. There are two ways to respond to this. On the first, we try to retain RT in some form in spite of Hedden's objection---I call this the permissive response below. On the second, we try to give a pragmatic argument for Probabilism using MSEU instead of RT---I call this the bookless response below. In the following sections, I will consider these in turn.

The Permissive Response

While Hedden is right to say that maximising expected utility in line with Maximise Subjective Expected Utility (MSEU) is intuitively rational even when your credences are incoherent, so is Ramsey's Thesis (RT). It is certainly intuitively correct that, to quote Hedden, ''we should judge actions by taking the sum of the values of each possible outcome of that action, weighted by one's credence that the action will result in that outcome.'' But it is also intuitively correct that, to quote from our gloss of Ramsey's Thesis above, ''(a) if you have minimal confidence in that proposition (i.e. 0), then you should be prepared to pay nothing for it; (b) if you have maximal confidence in it (i.e. 1), then you should be prepared to pay the full stake for it; (c) for levels of confidence in between, the amount you should be prepared to pay increases linearly with your credence.'' What are we to do in the face of this conflict between our intuitions?

One natural response is to say that choosing in line with RT is rationally permissible and choosing in line with MSEU is also rationally permissible. When your credences are coherent, the dictates of MSEU and RT are the same. But when you are incoherent, they are sometimes different, and in that situation you are allowed to follow either. In particular, faced with a bet and proposed price, you are permitted to pay that price if it is permitted by RT and you are permitted to pay it if it is permitted by MSEU.

If this is right, then we can resurrect the Dutch Book Argument with a permissive version of RT as the first premise:

Permissive Ramsey's Thesis Suppose your credence in $X$ in $c(X)$. Consider a bet that pays you £$S$ if $X$ is true and £0 if $X$ is false. You are offered this bet for the price £$x$. Then:

(i) If $x \leq c(X) \times S$, you are rationally permitted to pay £$x$ to enter into this bet.

And we could then amend the third premise---the Domination Thesis (DBA3)---to ensure we could still derive our conclusion. Instead of saying that credences are irrational if they mandate you to make a series of decisions that is guaranteed to leave you worse off than another series of decisions, we might say that credences are irrational if they permit you to make a series of decisions that is guaranteed to leave you worse off than another series of decisions. In the language of decision theory, instead of saying only that credences that mandate you to choose dominated options are irrational, we say also that credences that permit you to choose dominated options are irrational. We might call this the Permissive Domination Thesis.

Now, by weakening the first premise in this way, we respond to Hedden's objection and make the premise more plausible. But we strengthen the third premise to compensate and perhaps thereby make it less plausible. However, I imagine that anyone who accepts one of the versions of the third premise---either the Domination Thesis or the Permissive Domination Thesis---will also accept the other. Having credences that mandate dominated choices may be worse than having credences that permit such choices, but both seem sufficient for irrationality. Perhaps the former makes you more irrational than the latter, but it seems clear that the ideally rational agent will have credences that do neither. And if that's the case, then we can replace the standard Dutch Book Argument with a slight modification:

The Permissive Dutch Book Argument for Probabilism

(PDBA1) Permissive Ramsey's Thesis

(PDBA2) Dutch Book Theorem

(PDBA3) Permissive Domination Thesis

Therefore,

(PDBAC) Probabilism

The Bookless Response

Suppose you refuse even the permissive version of RT, and insist that coherent and incoherent agents alike should choose in line with MSEU. Then what becomes of the Dutch Book Argument? As we noted above, Hedden shows that it fails---MSEU is not sufficient to establish the conclusion. In particular, Hedden gives an example of an incoherent credence function that is not Dutch Bookable via MSEU. That is, there are no sets of bets with accompanying prices such that (a) MSEU will demand that you pay each of those prices, and (b) the sum of those prices is guaranteed to exceed the sum of the payouts of that set of bets. However, as we will see, accepting individual members of such a set of bets is just one way to make bad decisions based on your credences.

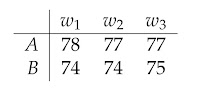

Consider Hedden's example. In it, you assign credences to propositions in the algebra built up from three possible worlds, $w_1$, $w_2$, and $w_3$. Here are some of your credences:

- $c(w_1 \vee w_2) = 0.8$ and $c(w_3) = 0$

- $c(w_1) = 0.7$ and $c(w_2 \vee w_3) = 0$

Then notice first that $A$ dominates $B$---that is, the utility of $A$ is higher than $B$ in every possible state of the world. But, using your incoherent credences, you assign a higher expected utility to $B$ than to $A$. Your expected utility for $A$---which must be calculated relative to your credences in $w_1$ and $w_2 \vee w_3$, since the utility of $A$ given $w_1 \vee w_2$ is undefined---is $0.7 \times 78 + 0 \times 77 = 54.6$. And your expected utility for $B$---which must be calculated relative to your credences in $w_1 \vee w_2$ and $w_3$, since the utility of $B$ given $w_2 \vee w_3$ is undefined---is $0.8 \times 74 + 0 \times 75 = 59.2$. So, while Hedden might be right that MSEU won't leave you vulnerable to a Dutch Book, it will leave you vulnerable to choosing a dominated option. And since what is bad about entering a Dutch Book is that it is a dominated option---it is dominated by the option of refusing the bets---the invulnerability to Dutch Books should be no comfort to you.

Now, this raises the question: For which incoherence credences is it guaranteed that MSEU won't lead you to choose a dominated option? Is it all incoherent credences, in which case we would have a new Dutch Book Argument for Probabilism from MSEU rather than RT? Or is it some subset? Below, we prove a theorem that answers that. First, a weakened version of Probabilism:

Bounded Probabilism If $c : \mathcal{F}\rightarrow [0, 1]$ is your credence function, then rationality requires that:

(BP1a) $c(\bot) = 0$, where $\bot$ is a necessarily false proposition;

(BP1b) There is $0 < M \leq 1$ such that $c(\top) = M$, where $\top$ is a necessarily true proposition;

(BP2) $c(A \vee B) = c(A) + c(B)$, if $A$ and $B$ are mutually exclusive.

Bounded Probabilism says that you should have lowest possible credence in necessary falsehoods, some positive credence---not necessarily 1---in necessary truths, and your credence in a disjunction of two incompatible propositions should be the sum of your credences in the disjuncts.

Theorem 1 The following are equivalent:

(i) $c$ satisfies Bounded Probabilism

(ii) For all options $A$, $B$, if $A$ dominates $B$, then $\mathrm{EU}_c(A) > \mathrm{EU}_c(B)$.

The proof is in the Appendix below. Thus, even without Ramsey's Thesis or the permissive version described above, you can still give a pragmatic argument for a norm that lies very close to Probabilism, namely, Bounded Probabilism. On its own, this argument cannot say what is wrong with someone who gives less than the highest possible credence to necessary truths, but it does establish the other requirements that Probabilism imposes. To see just how close to Probabilism lies Bounded Probabilism, consider the following two norms, which are equivalent to it:

Scaled Probabilism If $c : \mathcal{F} \rightarrow [0, 1]$ is your credence function, then rationality requires that there is $0 < M \leq 1$ and a probability function $p : \mathcal{F} \rightarrow [0, 1]$ such that $c(-) = M \times p(-)$.

Bounded Partition Probabilism If $c : \mathcal{F} \rightarrow [0, 1]$ is your credence function, then rationality requires that, for any two partitions $\mathcal{X} = \{X_1, \ldots, X_m\}$ and $\mathcal{Y} = \{Y_1, \ldots, Y_n\}$,$$\sum^m_{i=1} c(X_i) = \sum^n_{j=1} c(Y_j)

$$Then

Lemma 2 The following are equivalent:

(i) Bounded Probabilism

(ii) Scaled Probabilism

(iii) Bounded Partition Probabilism

As before, the proof is in the Appendix.

So, on its own, MSEU can deliver us very close to Probabilism. But it cannot establish (P1b), namely, $c(\top) = 1$. However, I think we can also appeal to a highly restricted version of the Permissive Ramsey's Thesis to secure (P1b) and push us all the way to Probabilism.

Consider Dima and Esther. They both have minimal confidence---i.e. 0---that it won't rain tomorrow. But Dima has credence 0.01 that it will rain, while Esther has credence 0.99 that it will. If we permit only actions that maximise expected utility, then Dima and Esther are required to pay exactly the same prices for bets on rain---that is, Dima will be required to pay a price exactly when Esther is. After all, if £$S$ is the payoff when it rains, £0 is the payoff when it doesn't, and $x$ is a proposed price, then $0.01\times (S- x) + 0 \times (0-x) \geq 0$ iff $0.99 \times (S-x) + 0 \times (0-x) \geq 0$ iff $S \geq x$. So, according to MSEU, Dima and Esther are rationally required to pay anything up to the stake of the bet for such a bet. But this is surely wrong. It is surely at least permissible for Dima to refuse to pay a price that Esther accepts. It is surely permissible for Esther to pay £99 for a bet on rain that pays £100 if it rains and £0 if it doesn't, while Dima refuses to pay anything more than £1 for such a bet, in line with Ramsey's Thesis. Suppose Dima were offered such a bet for the price of £99, and suppose she then defended her refusal to pay that price saying, 'Well, I only think it's 1% likely to rain, so I don't want to risk such a great loss with so little possible gain when I think the gain is so unlikely'. Then surely we would accept that as a rational defence.

In response to this, defenders of MSEU might concede that RT is sometimes the correct norm of action when you are incoherent, but only in very specific cases, namely, those in which you have a positive credence in a proposition, minimal credence (i.e. 0) in its negation, and you are considering the price you might pay for a bet on that proposition. In all other cases---that is, in any case in which your credences in the proposition and its negation are both positive, or in which you are considering an action other than a bet on a proposition---you should use MSEU. I have some sympathy with this. But, fortunately, this restricted version is all we need. After all, it is precisely by applying Ramsey's Thesis to such a case that we can produce a Dutch Book against someone with $c(\bot) = 0$ and $c(\top) < 1$---we simply offer to pay them £$c(\top) \times 100$ for a bet in which they will pay out £100 if $\top$ is true and £0 if it is false; this is then guaranteed to lose them £$100 \times (1-c(X))$, which is positive. Thus, we end up with a disjunctive pragmatic argument for Probabilism: if $c(\bot) = 0$ and $c(\top) < 1$, then RT applies and we can produce a Dutch Book against you; if you violate Probabilism in any other way, then you violate Bounded Probabilism and we can then produce two options $A$ and $B$ such that $A$ dominates $B$, but your credences, via MSEU, dictate that you should choose $B$ over $A$. This, then, is our bookless pragmatic argument for Probabilism:

Bookless Pragmatic Argument for Probabilism

(BPA1) If $c$ violates Probabilism, then either (i) $c(\bot) = 0$ and $c(\top) < 1$, or (ii) $c$ violates Bounded Probabilism.

(BPA2) If $c(\bot) = 0$ and $c(\top) < 1$, then RT applies, and there is a bet on $\top$ such that you are required by RT to pay a higher price for that bet than its guaranteed payoff. Thus, there are options $A$ and $B$ (namely, refuse the bets and pay the price), such that $A$ dominates $B$, but RT demands that you choose $B$ over $A$.

(BPA3) If $c$ violates Bounded Probabilism, then by Theorem 1, there are options $A$ and $B$ such that $A$ dominates $B$, but RT demands that you choose $B$ over $A$. Therefore, by (BPA1), (BPA2), and (BPA3),

(BPA4) If $c$ violates Probabilism, then there are options $A$ and $B$ such that $A$ dominates $B$, but rationality requires you to choose $B$ over $A$.

(BPA5) Dominance Thesis

Therefore,

(BPAC) Probabilism

Conclusion

The Dutch Book Argument for Probabilism assumes Ramsey's Thesis, which determines the prices an agent is rationally required to pay for a bet. Hedden argues that Ramsey's Thesis is wrong. He claims that Maximise Subjective Expected Utility determines those prices, and it often disagrees with RT. In our Permissive Dutch Book Argument, I suggested that, in the face of that disagreement, we might be permissive: agents are permitted to pay any price that is required or permitted by RT and they are permitted to pay any price that is required or permitted by MSEU. In our Bookless Pragmatic Argument, I then explored what we might do if we reject this permissive response and insist that only prices permitted or required by MSEU are permissible. I showed that, in that case, we can give a pragmatic argument for Bounded Probabilism, which comes close to Probabilism, but doesn't quite reach; and I showed that, if we allow RT in the very particular cases in which it agrees better with intuition than MSEU does, we can give a pragmatic argument for Probabilism.

Appendix: Proof of Theorem 1

Theorem 1 The following are equivalent:

(i) $c$ satisfies Bounded Probabilism

(ii) For all options $A$, $B$, if $A$ dominates $B$, then $\mathrm{EU}_c(A) > \mathrm{EU}_c(B)$.

($\Rightarrow$) Suppose $c$ satisfies Bounded Probabilism. Then, by Lemma 2, there is $0 < M \leq 1$ and a probability function $p$ such that $c(-) = M \times p(-)$. Now suppose $A$ and $B$ are actions. Then

- $\mathrm{EU}_c(A) = \mathrm{EU}_{M \times p}(A) = M \times \mathrm{EU}_p(A)$

- $\mathrm{EU}_c(B) = \mathrm{EU}_{M \times p}(B) = M \times \mathrm{EU}_p(B)$

($\Leftarrow$) Suppose $c$ violates Bounded Probabilism. Then there are partitions $\mathcal{X} = \{X_1, \ldots, X_m\}$ and $\mathcal{Y} = \{Y_1, \ldots, Y_n\}$ such that $$\sum^m_{i=1} c(X_i) = x < y = \sum^n_{j=1} c(Y_j)$$We will now define two acts $A$ and $B$ such that $A$ dominates $B$, but $\mathrm{EU}_c(A) < \mathrm{EU}_c(B)$.

- For any $X_i$ in $\mathcal{X}$, $$U(A, X_i) = y - i\frac{y-x}{2(m + 1)}$$

- For any $Y_j$ in $\mathcal{Y}$,$$U(B, Y_j) = x + j\frac{y-x}{2(n + 1)}$$

- For any two $X_i \neq X_j$ in $\mathcal{X}$,$$U(A, X_i) \neq U(A, X_j)$$

- For any two $Y_i \neq Y_j$ in $\mathcal{Y}$,$$U(B, Y_i) \neq U(B, Y_j)$$

- For any $X_i$ in $\mathcal{X}$ and $Y_j$ in $\mathcal{Y}$, $$x < U(B, Y_j) < \frac{x+y}{2} < U(A, X_i) < y$$

while$$\mathrm{EU}_c(B) = \sum^n_{j=1} c(Y_i) U(B, Y_j) > \sum^n_{j=1} c(Y_j) \times x = yx$$So $\mathrm{EU}_c(B) > \mathrm{EU}_c(A)$, as required.

Comments

Post a Comment